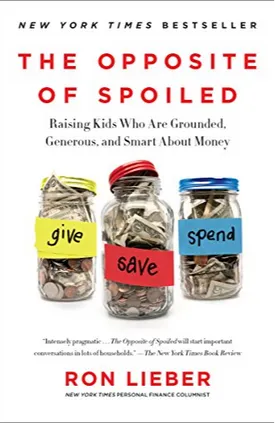

The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous, and Smart About Money by Ron Lieber

Raising children is incredibly important for parents and guardians, and a critical aspect of child rearing is teaching children about money. In his book "The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous, and Smart About Money," author Ron Lieber provides readers with valuable strategies for helping their children establish financial literacy. Using an approach Lieber has developed over many years of researching, writing, consulting and parenting, readers are given sound guidance grounded in an appreciation for the complexity of today's economic climate.

The first part of the book focuses on finding the right language to use when addressing money and financial topics with children. Lieber points out that language we use when talking about money has the power to shape a child's outlook and understanding of it. "To help children grow into responsible adults," explains Lieber, "we have to equip them with the right vocabulary and assist them in understanding the values of money and financial responsibility". He advises readers to avoid language that misrepresents or oversimplifies the way money works in the real world, and to strive to be honest and transparent when discussing the topic with their kids.

Lieber then provides parents with an in-depth look into how best to automate their children's finances. For example, he recommends setting up automatic saving and spending accounts for kids and having them manage their money themselves as much as possible. This way, children are used to seeing money as a tool for achieving their goals, instead of a source of instant gratification.

Building on the automation strategy, Lieber recommends a "kitchen cabinet" approach to teaching kids about money. This involves giving children access to a secure image bank of different financial instruments, like mutual funds, opportunities and stocks. As they get older, they would be able to see their financial future in the context of their own retirement.

The rest of the book goes on to discuss how to cultivate generosity in kids and the importance of engaging in compassionate conversations about financial topics. Lieber encourages readers to embrace an attitude of anxious generosity, an idea Lieber uses to explain how parents can teach children to balance freedom and responsibility when making financial decisions. Doing so, he argues, will help parents inculcate in their children the idea that financial decisions are an integral part of ethical living.

Overall, "The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous, and Smart About Money" provides parents and guardians with a wealth of helpful advice on how to make money discussions with their children substantially less daunting. With the help of Lieber's guidance, parents can develop a secure, positive understanding of money in the minds of their kids and give them the tools they need to make wise financial decisions in the future.